Centre Must Ensure That Rich Indians Do Not Leave The Country

Centre Must Ensure That Rich Indians Do Not Leave The Country

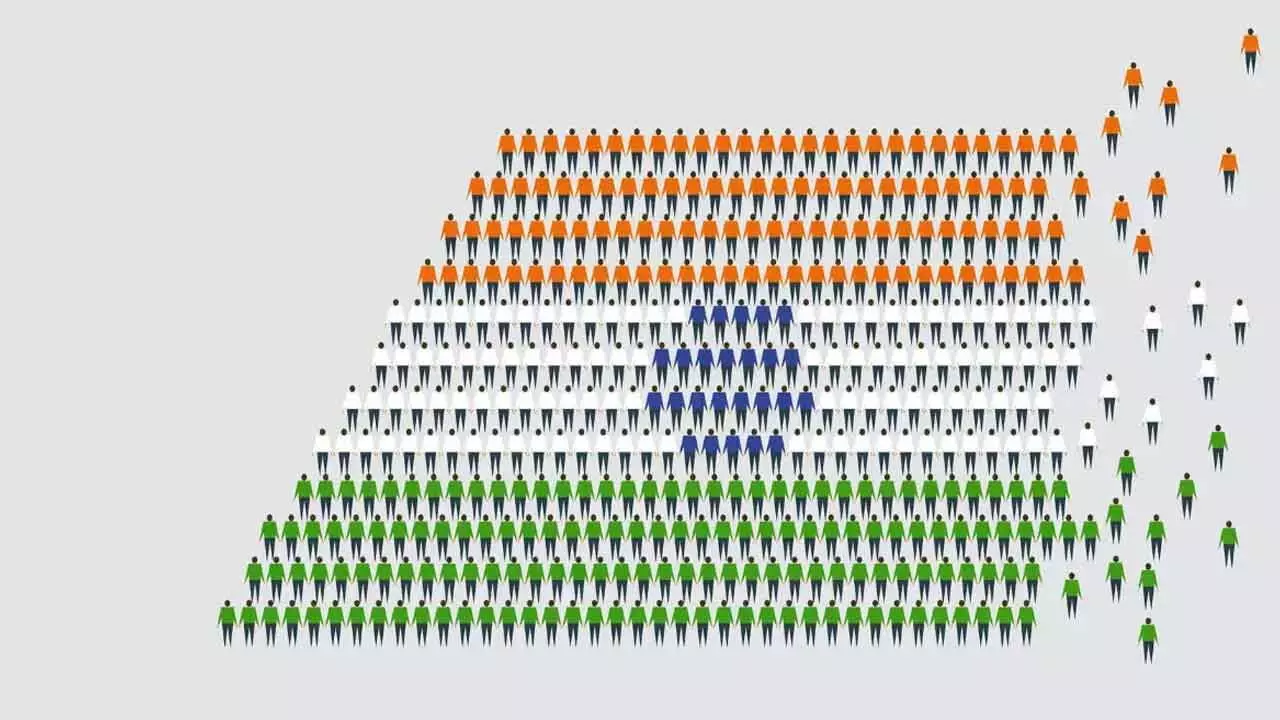

The wealthy leaving India is a depressing development. While this phenomenon is part of a broader global trend, with China and the UK topping the chart, India’s position as the third-largest contributor to this migration is a matter of grave concern. Recent findings by Kotak Private in collaboration with EY highlight the extent of the issue. According to their survey, a notable proportion of India’s ultra-high-net-worth individuals (UHNIs) are contemplating relocating abroad. UHNIs are those with a net worth of more than Rs. 25 crore. The survey, conducted among 150 UHNIs, reveals that at least 22 per cent of India’s super-rich are considering emigration, stemming from factors like relatively better living conditions, higher standards of life, and a more favourable business environment. These parameters make destinations like the United States, the United Kingdom, Canada, and the United Arab Emirates particularly attractive to India’s wealthiest citizens.

As of 2023, there were 2.18 lakh Indian UHNIs with a combined wealth of Rs. 232 lakh crore. This figure is expected to grow to 4.3 lakh for an overall wealth of Rs. 359 lakh crore by 2028, as per the survey.

This forecast not only indicates a substantial increase in wealth creation; it also underscores the potential risks associated with the continued outflow of affluent individuals and their capital. A report published by Henley & Partners last year suggested that the exodus of millionaires from India was slowing down. While an estimated 4,300 HNWIs were projected to leave the country in 2024, this figure marked a notable decline compared to the previous years. In 2023, approximately 5,100 wealthy individuals emigrated, a reduction from the 7,500, who had left the shores in 2022. This decreasing trend in millionaire migration could be interpreted as a sign of economic stabilisation, reflecting a more favourable business climate or improved domestic conditions. However, there is no room for complacency. The government must proactively implement reforms to create a more conducive environment for wealth retention and economic growth. Deregulation should be accelerated to ease the burdensome bureaucratic processes that often hinder business operations. To foster a more business-friendly environment, the government must further simplify tax structures, ensure policy stability and reduce, if not eliminate, red tape.

These measures can incentivize the wealthy to remain in the country. Improving infrastructure, healthcare, and overall quality of life will also play a crucial role in making India a more attractive place for its affluent citizens to stay and invest in. Additionally, the role of central agencies, such as the Enforcement Directorate (ED), needs careful reassessment. Many affluent individuals fear arbitrary scrutiny and excessive regulatory intervention, which can contribute to their decision to relocate to countries with more predictable and transparent legal frameworks. This move can have major economic repercussions for India as they will take not only their money but also their investments, entrepreneurial expertise, and job-creating potential. This could have long-term negative implications for economic growth, innovation, and employment. Moreover, their departure could indicate a lack of confidence in the country’s economic policies, further discouraging foreign investors and reducing capital inflows. India’s economic future depends on retaining and nurturing its wealth creators and thereby ensuring that its economic progress remains robust.